Top 20 Car Insurance Discounts (New)

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Leslie Kasperowicz

Farmers CSR for 4 Years

Leslie Kasperowicz holds a BA in Social Sciences from the University of Winnipeg. She spent several years as a Farmers Insurance CSR, gaining a solid understanding of insurance products including home, life, auto, and commercial and working directly with insurance customers to understand their needs. She has since used that knowledge in her more than ten years as a writer, largely in the insuranc...

Farmers CSR for 4 Years

UPDATED: Jan 13, 2022

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Jan 13, 2022

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident car insurance decisions. Comparison shopping should be easy. We are not affiliated with any one car insurance company and cannot guarantee quotes from any single company.

Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from top car companies please enter your ZIP code above to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

| Discounts | 21st Century | AAA | Allstate | American Family | Ameriprise | Amica | Country Financial | Esurance | Farmers | Geico | Liberty Mutual | MetLife | Nationwide | Progressive | Safe Auto | Safeco | State Farm | The General | The Hanover | The Hartford | Travelers | USAA |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Adaptive Cruise Control | x | x | x | x | ||||||||||||||||||

| Adaptive Headlights | x | x | x | x | x | x | x | x | ||||||||||||||

| Anti-lock Brakes | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x |

| Anti-Theft | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x |

| Claim Free | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x |

| Continuous Coverage | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | |||||||

| Daytime Running Lights | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | ||||

| Defensive Driver | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x |

| Distant Student | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | |||||||

| Driver's Ed | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | ||

| Driving Device/App | x | x | x | x | x | x | x | x | x | x | x | x | x | |||||||||

| Early Signing | x | x | x | x | x | x | x | x | x | x | x | x | x | x | ||||||||

| Electronic Stability Control | x | x | x | x | x | x | x | x | x | |||||||||||||

| Emergency Deployment | x | |||||||||||||||||||||

| Engaged Couple | x | |||||||||||||||||||||

| Family Legacy | x | x | x | x | x | x | ||||||||||||||||

| Family Plan | x | x | x | x | x | |||||||||||||||||

| Farm Vehicle | x | x | x | x | ||||||||||||||||||

| Fast 5 | x | |||||||||||||||||||||

| Federal Employee | x | x | x | x | ||||||||||||||||||

| Forward Collision Warning | x | x | x | x | x | x | x | |||||||||||||||

| Full Payment | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | |||||

| Further Education | x | x | x | x | x | x | x | x | x | |||||||||||||

| Garaging/Storing | x | x | x | x | x | x | ||||||||||||||||

| Good Credit | x | x | x | x | ||||||||||||||||||

| Good Student | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x |

| Green Vehicle | x | x | x | x | x | x | x | |||||||||||||||

| Homeowner | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | ||||

| Lane Departure Warning | x | x | x | x | ||||||||||||||||||

| Life Insurance | x | x | ||||||||||||||||||||

| Low Mileage | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | |||

| Loyalty | x | x | x | x | x | x | x | x | x | x | x | x | ||||||||||

| Married | x | x | x | x | x | x | x | x | x | x | x | x | x | x | ||||||||

| Membership/Group | x | x | x | x | x | x | x | x | x | x | x | |||||||||||

| Military | x | x | x | x | x | x | x | x | x | x | ||||||||||||

| Military Garaging | x | |||||||||||||||||||||

| Multiple Drivers | x | x | ||||||||||||||||||||

| Multiple Policies | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | |

| Multiple Vehicles | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | |

| New Address | x | |||||||||||||||||||||

| New Customer/New Plan | x | x | x | |||||||||||||||||||

| New Graduate | x | |||||||||||||||||||||

| Newer Vehicle | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | ||||||

| Newly Licensed | x | |||||||||||||||||||||

| Newlyweds | x | |||||||||||||||||||||

| Non-Smoker/Non-Drinker | x | |||||||||||||||||||||

| Occasional Operator | x | |||||||||||||||||||||

| Occupation | x | x | x | x | x | x | x | x | x | x | x | x | ||||||||||

| On Time Payments | x | x | x | x | ||||||||||||||||||

| Online Shopper | x | x | ||||||||||||||||||||

| Paperless Documents | x | x | x | x | x | x | x | x | ||||||||||||||

| Paperless/Auto Billing | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | |||||

| Passive Restraint | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x |

| Recent Retirees | x | x | ||||||||||||||||||||

| Renter | x | x | x | |||||||||||||||||||

| Roadside Assistance | x | x | ||||||||||||||||||||

| Safe Driver | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | |||

| Seat Belt Use | x | |||||||||||||||||||||

| Senior Driver | x | x | x | x | x | x | x | x | x | |||||||||||||

| Stable Residence | x | x | x | x | ||||||||||||||||||

| Students and Alumni | x | x | x | x | x | x | ||||||||||||||||

| Switching Provider | x | x | x | x | x | x | x | x | x | x | x | |||||||||||

| Utility Vehicle | x | x | x | x | ||||||||||||||||||

| Vehicle Recovery | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | x | |

| VIN Etching | x | x | x | x | x | x | x | x | x | x | ||||||||||||

| Volunteer | x | |||||||||||||||||||||

| Young Driver | x | x | x | x | x | x | ||||||||||||||||

| Discounts Provided # | 21 | 21 | 29 | 27 | 18 | 27 | 26 | 34 | 34 | 31 | 38 | 38 | 35 | 36 | 22 | 30 | 19 | 20 | 22 | 38 | 28 | 28 |

Car insurance can be expensive. Most people view insurance as the dreaded necessity you must have to be able to drive. So what can you do to make the premium a little better?

A helpful way you can make sure you’re getting the cheapest rate is to make yourself aware of the discounts available. Most insurance companies offer several discount options.

Whether you’re in the military, own your home, or are a safe driver, we can help you find some discounts for your car insurance policy.

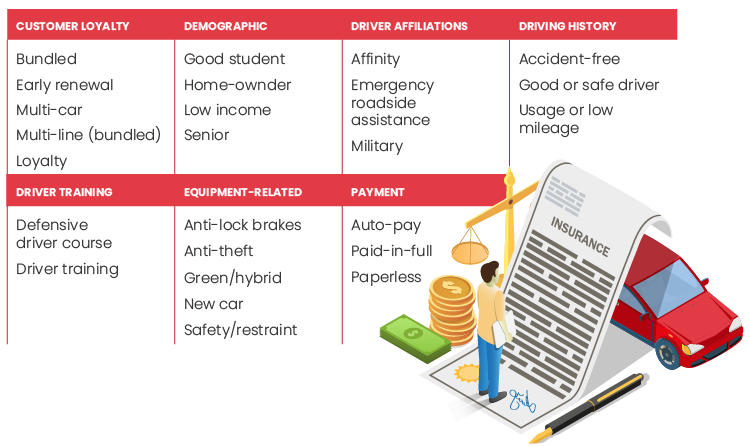

Discounts are divided into different categories. Insurance companies have driver-based, vehicle-based, and policy-based discounts. We’re going to cover all these categories below.

You’ll also want to get quotes from multiple carriers, but don’t worry. We can help you with that too. Enter your ZIP code to start shopping for cheaper insurance rates.

Driver-Based Discounts for Car Insurance

First, let’s take a look at driver-based discounts. What do we mean by driver-based? It’s any discount that can be given for just being you, the driver.

Are you in the military? Are you a senior citizen? Keep reading below to take a look at what driver-based discounts you could take advantage of when shopping for car insurance.

#1 – Military Discounts

If you’re a military member or eligible family member, you could be qualified for military discounts from several car insurance companies.

The following companies have discounts for military personnel:

- Allstate

- Esurance

- Farmers

- Geico

- Liberty Mutual

- MetLife

- Safe Auto

- Safeco

- The General

- USAA

While this list gives eligible military members a lot of choices to choose from for insurance, USAA rates top of the list for discounted rates. USAA also offers a military garaging discount.

USAA not only gives military members excellent rates but also provides military discounts to veterans and eligible family members, as well.

| State | USAA | Average by State |

|---|---|---|

| Median | $2,489.49 | $3,660.89 |

| Alabama | $2,124.09 | $3,566.96 |

| Alaska | $2,454.21 | $3,421.51 |

| Arizona | $3,084.29 | $3,770.97 |

| Arkansas | $2,171.06 | $4,124.98 |

| California | $2,693.87 | $3,688.93 |

| Colorado | $3,338.87 | $3,876.39 |

| Connecticut | $3,190.00 | $4,618.92 |

| Delaware | $2,325.98 | $5,986.32 |

| District of Columbia | $2,580.44 | $4,439.24 |

| Florida | $2,850.41 | $4,680.46 |

| Georgia | $3,157.46 | $4,966.83 |

| Hawaii | $1,189.35 | $2,555.64 |

| Idaho | $1,877.61 | $2,979.09 |

| Illinois | $2,770.21 | $3,305.48 |

| Indiana | $1,630.86 | $3,414.97 |

| Iowa | $1,852.57 | $2,981.28 |

| Kansas | $2,382.61 | $3,279.62 |

| Kentucky | $2,897.89 | $5,195.40 |

| Louisiana | $4,353.12 | $5,711.34 |

| Maine | $1,930.79 | $2,953.28 |

| Maryland | $2,744.14 | $4,582.70 |

| Massachusetts | $1,458.99 | $2,678.85 |

| Michigan | $3,620.00 | $10,498.64 |

| Minnesota | $2,861.60 | $4,403.25 |

| Mississippi | $2,056.13 | $3,664.57 |

| Missouri | $2,525.78 | $3,328.93 |

| Montana | $2,031.89 | $3,220.84 |

| Nebraska | $2,330.78 | $3,283.68 |

| Nevada | $3,069.07 | $4,861.70 |

| New Hampshire | $1,906.96 | $3,151.77 |

| New Jersey | Data Not Available | $5,515.21 |

| New Mexico | $2,296.77 | $3,463.64 |

| New York | $3,761.69 | $4,289.88 |

| North Carolina | Data Not Available | $3,393.11 |

| North Dakota | $2,006.80 | $4,165.84 |

| Ohio | $1,478.46 | $2,709.71 |

| Oklahoma | $3,174.15 | $4,142.33 |

| Oregon | $2,587.15 | $3,467.77 |

| Pennsylvania | $1,793.37 | $4,034.50 |

| Rhode Island | $4,323.98 | $5,003.36 |

| South Carolina | $3,424.77 | $3,781.14 |

| South Dakota | Data Not Available | $3,982.27 |

| Tennessee | $2,739.28 | $3,660.89 |

| Texas | $2,487.89 | $4,043.28 |

| Utah | $2,491.10 | $3,611.89 |

| Vermont | $1,903.55 | $3,234.13 |

| Virginia | $1,858.38 | $2,357.87 |

| Washington | $2,262.16 | $3,059.32 |

| West Virginia | $1,984.62 | $2,595.36 |

| Wisconsin | $2,975.74 | $3,606.06 |

| Wyoming | $2,779.53 | $3,200.08 |

USAA rates are well below the average rate for all states where they are available.

#2 – Good Student Discounts

Students can be drowning in not only homework but insurance bills as well. Some insurance providers give a welcomed break in rates for good students. This is good news for students paying for their own insurance or for parents footing the bill.

Each insurance company may require different items to prove a student qualifies for a good student discount. For instance, Nationwide offers this discount to drivers 16–24 years of age and can prove they maintain a B average. Proof can consist of showing a current report card or a form signed by a school administrator.

Geico offers up to a 15 percent discount if you qualify for their good student discount. State Farm is even better, with a potential savings of 25 percent.

Check with your insurance carrier for guidelines.

#3 – Senior Discounts

The young are the only drivers who get discounts. Most insurance companies offer senior citizens discounts as well. Allstate offers a 55 and Retired discount, while Geico offers a Prime Time discount.

To qualify for the Prime Time discount with Geico, you must meet the following guidelines:

- No drivers under 25 years of age added to the policy

- No violations or accidents in the last three years

- No vehicles that are used for a business listed on the policy

Seniors can also save on their insurance by changing the status of their driving. For instance, if you’re retired and no longer commuting to work, you can update your driving status to leisure. This will often lower your car insurance rate due to the fact you’re no longer driving as much.

#4 – Professional and Academic Organizations, Employee Discounts

You may not know this, but you can get car insurance discounts because of memberships in associations and organizations. This is a discount most consumers don’t know about.

Insurance companies partner with large corporations to give group rates to employees. This is a great benefit to offer employees and in turn, the insurance company gains new clients. If you’re an employee in a large company, check with your employer to see if this is an available discount.

Your employer isn’t the only organization or association to help lower your car insurance with discounts. Alumni associations, credit unions, and other organizations also have an added benefit of receiving a discount from some car insurance companies.

Check with your car insurance company to make sure you’re getting all the discounts available.

#5 – Accident-Free

A lot of factors go into getting you an insurance rate. Car insurance companies look at many factors such as age, credit history, coverage, and driving record, just to name a few.

While your driving record isn’t the only thing a car insurance company looks at, it definitely doesn’t hurt to have a clean record. Not only will you get a lower rate for having a driving record with no convictions or violations, but some companies also offer a discount for being accident-free.

State Farm offers an accident-free discount if a car listed on your policy has gone three years without a chargeable accident. As time goes on, the discount gets larger. So the longer you go without an accident, the more potential for receiving a bigger discount.

Geico offers a similar discount. To receive the Geico accident-free discount, drivers must have no accidents for five years and can potentially save up to 26 percent off their coverage.

Nationwide is comparable to Geico, offering a discount for drivers having no accidents for five continuous years.

#6 – Defensive Driver Education Discount

Ever had to take a defensive driver course? If you have a clean record and aren’t mandated by court order to take one, you may be eligible for a car insurance discount.

All states have different regulations and rules on defensive driver courses and how the discount can be applied. So check with your state to see if this option is available.

For instance, if you live in South Carolina and have Geico car insurance, you can receive up to a 10 percent discount on your car insurance for taking an approved defensive driving course.

State Farm also offers a defensive driving discount, but again, check with your agent for state rules and regulations.

If you’re over 55 years of age and had no at-fault accidents in the past 35 months, Nationwide offers a defensive driver discount in select states.

#7 – Away-From-Home Student Discount

This is a great discount available for parents with children away at school. Some companies offer discounts on your car insurance if your child is away at school.

In most cases, the child has to be at least 100 miles away and be under 25 years of age. The away-from-home students can’t have a car while they’re away and can only use the car for visits home during summer or holidays to be eligible for this discount.

#8 – Usage-Based Driving Discount

Usage-based driving discounts are becoming very popular with car insurance companies. This technology allows car insurance companies to track the driving habits of their insureds by installing a device in the car or through their smartphone.

This allows car insurance companies not only to rate drivers on past records or rating factors, but it also allows them to rate in real-time.

It also tailors the rate to the individual. For instance, you may drive under five miles to work at lower speeds and your car insurance company can’t usually factor that into your rates.

With usage-based technology, though, they can now track the exact mileage, speed, and in some cases, your braking habits.

While some drivers would love to get lower rates, they aren’t willing to give their personal location and driving habits for a lower rate. That’s the downside of usage-based ratings or discounts. People like their privacy and don’t want their insurance company following them in the car everywhere they go.

Curious if your current car insurance company has usage-based discounts? Chances are they do. Progressive has Snapshot, Allstate has Drivewise, Nationwide has SmartRide, Travelers has IntelliDrive, and Safeco has RightTrack.

Here’s a video highlighting State Farm’s usage-based program.

If you’re wondering about your car insurance company, contact your local agent today. Enter your zip code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Policy-Based Discounts for Car Insurance

Discounts are also available based on policy factors and not the driver. Paying in full, multiple policies, and auto-pay are all discounts available for consumers to take advantage of when shopping for car insurance.

#9 – Homeowner Discount

Owning a home can give you discounts on your car insurance — but only in some states. California has mandated that homeownership is not to be used as a rating factor for car insurance.

But why does owning a home affect your car insurance rate?

Car insurance companies see homeowners as less risky clients and less likely to file claims. Homeowners are viewed as more stable consumers.

This moves us into the next discount that could also be available to homeowners.

#10 – Multi-Policy Discount

Car insurance companies want not only your car insurance but every other line of business they can get. So the more items you have to cover, the better.

Your home is usually the other biggest line the insurance company wants to insure. The biggest assets of most families are their home and their vehicles. Insuring them with the same insurance company is an easy way to get a discount on your car insurance.

State Farm offers up to a 17 percent discount if you add home, renters, condo, or life insurance to your insurance bundle.

Not all companies write all lines of business, though. Check with your carrier to see what lines they offer and how much the discount would be to move other lines of business to them.

#11 – Paying in Full

Many consumers don’t know this discount is available. Insurance companies give you the down payment and the monthly rate, you sign up, and the rest is history.

This is an important discount to ask about if you have the money to pay in full. Companies will usually require a processing fee added to your insurance payment every month. That adds up for every year of insurance.

Progressive is one of the many car insurance companies that offer a paying in full discount.

#12 – Paperless Statements

More and more insurance companies are offering paperless statements. But not all of them offer a discount just because you sign up.

One company, American Family, does offer a discount for going paperless. You just need to sign up within 10 days of starting your car insurance policy.

Going paperless has more benefits than just the discount. It allows you to access all paperwork in one location.

#13 – Auto-Pay

Auto-pay is the easiest way to never forget your car insurance payment again. And most insurance companies will give you a discount for using their auto-pay service.

American Family offers a discount when you sign up for auto-pay with your debit or credit card. You can also use a checking or savings account to use this service.

Progressive is another company that will also offer you a discount for using their auto-pay service.

Vehicle Discounts for Car Insurance

Lastly, let’s take a look at what kinds of discounts are available for the type of car you drive. These discounts are based solely on safety features, the type of car, or how many cars listed on the car insurance policy.

#14 – Safety Features Discounts

Car insurance companies love a safe car. If you get in an accident, a safer car could change the total outcome. Injuries may be less severe and damage could be less costly. So it’s a win for the driver and the insurance company that may have a potential claim filed with them.

Many insurance companies gladly offer discounts for safer vehicles. State Farm offers a vehicle safety discount if your car was made in 1994 or later. Depending on the exact make and model, you could receive up to 40 percent off your medical-related coverage.

Keep reading to find out specific safety features that can add more discounts to your car insurance.

#15 – New Car

New cars are costly. Don’t worry, though. You can save some money with your car insurance.

Allstate offers policyholders up to a 15 percent discount for owning a new car. Your car can even be one model year older than the current year if you’re the first owner.

Geico offers a similar discount with savings of up to 15 percent. New vehicles can be three model years old or newer to be eligible for this discount.

If you have a newer car or are looking to buy, don’t forget to ask about a new car discount.

#16 – Daytime Running Lights

Daytime running lights are usually a standard option on newer cars. If you have a newer model, you may be eligible for a discount with your car insurance.

Daytime running lights aren’t a well-known discount, but they should definitely be mentioned, with more companies offering the discount and more cars having them.

It may be small, but Geico offers a 1 percent discount on certain car insurance coverage for having daytime running lights.

#17 – Anti-Theft Car Insurance Discount

Does your car have a factory-installed alarm or other anti-theft devices? If the answer is yes, then you may be eligible for an anti-theft car insurance discount.

Comprehensive coverage covers theft, and if you have an alarm system, this could save you and your insurance company a big comprehensive claim for a stolen vehicle.

Geico offers up to a 25 percent discount on the comprehensive portion of your coverage.

State Farm also offers a discount if you have an alarm or other approved anti-theft device.

#18 – Anti-Lock Brakes (ABS)

Another safety feature that can get you a discount on your car insurance is anti-lock brakes. Having this feature could save you in an accident, and insurance companies want to promote this feature by offering a discount.

Geico offers up to a 5 percent discount on the portion of your insurance premium collected for collision coverage.

Other companies offer up to a 10 percent discount.

#19 – Passive Restraint

Airbags and seatbelts can save lives when used properly and involved in a car accident. Most cars have air bags and passive restraint systems. Make sure you are receiving your discount on your car insurance for having these safety features.

State Farm offers a passive restraint discount for cars 1993 and older that are equipped with passive restraint systems or factory-installed air bags. The discount can be up to 40 percent on medical-related coverages.

Geico offers up to 25 percent for driver-side air bags and as much as 40 percent for full front-seat air bags. Again, these discounts are applied to medical or personal injury coverages.

Allstate also offers a discount for passive restraints, which includes motorized seat belts. You can receive up to 30 percent off your premium.

#20 – Multi-Car Discount

We talked earlier about multiple lines of business receiving discounts, but did you know multiple vehicles will also get you a car insurance discount?

State Farm offers up to a 20 percent discount for having two or more vehicles listed on your policy.

Progressive has a slightly smaller discount at 12 percent. Geico offers one of the highest multi-car discounts of up to 25 percent.

Remember, you can add any vehicle that stays at your home address to your policy. It can be driven by a spouse or other family member. Enter your zip code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Tips for Getting Lower Car Insurance

Discounts are a great way to help lower the cost of your car insurance premiums. But there are other options to help lower the burden of costly insurance.

Shop for Your Car Insurance

Car insurance companies change rates. Some years one company may be lower and if they have a rate increase, they may no longer be a good fit for you and your car insurance needs.

But remember, don’t always settle for the cheapest. Get multiple rates and compare coverages to make sure you’re fully covered if a loss occurs.

Look at Raising Your Deductible

If your car is being financed, you may not have the option to change your deductible. If you have full coverage insurance and own the car, you can raise your comprehensive and collision deductibles.

While this can save you money on your car insurance premium, you’ll want to make sure you have the money set aside to pay your deductible if you need to file a claim.

Keep an Eye on Your Credit and Driving Record

Two factors that car insurance companies look at is your credit history and your driving record. These two factors can drastically change your insurance rate.

Credit history can greatly impact your car insurance rate.

| Credit History | Fair | Good | Poor |

|---|---|---|---|

| Allstate | $4,581.16 | $4,058.97 | $6,490.65 |

| American Family | $3,169.53 | $2,691.74 | $4,467.98 |

| Farmers | $3,899.41 | $3,628.85 | $4,864.14 |

| Geico | $2,986.79 | $2,434.82 | $4,259.50 |

| Liberty Mutual | $5,604.24 | $4,388.18 | $8,802.22 |

| Nationwide | $3,254.83 | $2,925.94 | $4,737.64 |

| Progressive | $3,956.31 | $3,677.12 | $4,951.20 |

| State Farm | $2,853.00 | $2,174.26 | $4,083.29 |

| Travelers | $4,344.10 | $3,859.66 | $5,160.22 |

| USAA | $2,219.83 | $1,821.20 | $3,690.73 |

Liberty Mutual has a drastically different rate for someone with good credit versus poor credit. It can cost over $4,000 more a year in car insurance premiums with poor credit.

Your driving record is also a very important factor for your rate. More tickets, accidents, and DUIs can cause a huge spike in car insurance premiums.

| Driving Record | Clean Record | With One Accident | With One DUI | With One Speeding Violation |

|---|---|---|---|---|

| Allstate | $3,819.90 | $4,987.68 | $6,260.73 | $4,483.51 |

| American Family | $2,693.61 | $3,722.75 | $4,330.24 | $3,025.74 |

| Farmers | $3,460.60 | $4,518.73 | $4,718.75 | $4,079.01 |

| Geico | $2,145.96 | $3,192.77 | $4,875.87 | $2,645.43 |

| Liberty Mutual | $4,774.30 | $6,204.78 | $7,613.48 | $5,701.26 |

| Nationwide | $2,746.18 | $3,396.95 | $4,543.20 | $3,113.68 |

| Progressive | $3,393.09 | $4,777.04 | $3,969.65 | $4,002.28 |

| State Farm | $2,821.18 | $3,396.01 | $3,636.80 | $3,186.01 |

| Travelers | $3,447.69 | $4,289.74 | $5,741.40 | $4,260.80 |

| USAA | $1,933.68 | $2,516.24 | $3,506.03 | $2,193.25 |

Allstate charges a driver almost $3,000 more for a DUI conviction versus someone with a clean record. If you have a DUI conviction, chances are you’re paying the highest rate with most insurance companies.

Being a safe and cautious driver can help prevent unnecessary tickets and violations, leading to a higher insurance premium.

Bottom Line

Insurance can be expensive, and you want to know you’re getting a good price for your coverage. We understand you want to get the best deal.

Start shopping for your insurance today by entering your ZIP code. Use your knowledge of discounts to make sure you’re getting the cheapest rate available for your needs.

References:

- https://www.forbes.com/advisor/insurance/car-insurance-discounts/

- https://www.naic.org/documents/consumer_alert_understanding_usage_based_insurance.htm

- https://money.com/car-insurance-more-for-renters-than-homeowners/

- https://www.iii.org/article/nine-ways-to-lower-your-auto-insurance-costs

- https://www.thestreet.com/personal-finance/insurance/car-insurance/your-cars-daytime-running-lights-can-save-you-auto-insurnace-12823117

- https://www.iii.org/article/how-can-i-save-money-auto-insurance

- https://www.iii.org/article/understanding-your-insurance-deductibles

Enter your zip code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Leslie Kasperowicz

Farmers CSR for 4 Years

Leslie Kasperowicz holds a BA in Social Sciences from the University of Winnipeg. She spent several years as a Farmers Insurance CSR, gaining a solid understanding of insurance products including home, life, auto, and commercial and working directly with insurance customers to understand their needs. She has since used that knowledge in her more than ten years as a writer, largely in the insuranc...

Farmers CSR for 4 Years

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.